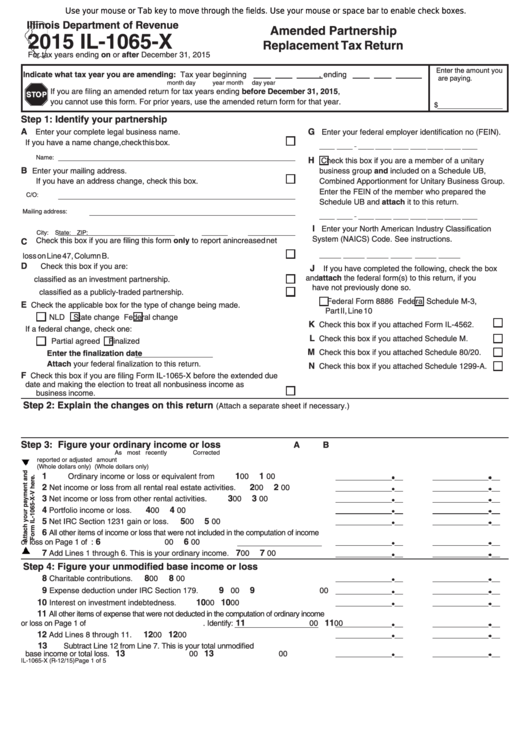

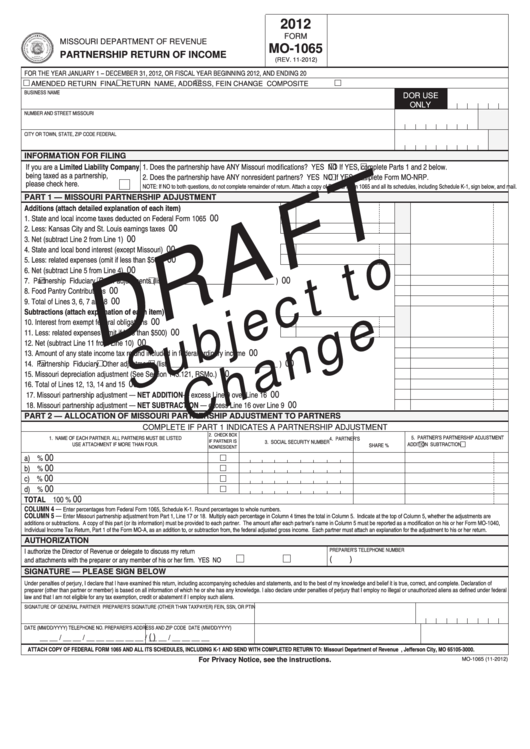

It’s a tax form filed by partnerships-including LLCs taxed as partnerships-with the IRS. Partnerships are not taxed as entities, but rather the income is passed through to the partners and taxed on their individual tax returns.įorm 1065 is the U.S.The form reports the income, deductions, gains, and losses of a partnership agreement.Form 1065 is the annual return that a partnership agreement must file with the IRS.Send invoices, track time, manage payments, and more…from anywhere. Pay your employees and keep accurate books with Payroll software integrationsįreshBooks integrates with over 100 partners to help you simplify your workflows Set clear expectations with clients and organize your plans for each projectĬlient management made easy, with client info all in one place Organized and professional, helping you stand out and win new clients Track project status and collaborate with clients and team members Time-saving all-in-one bookkeeping that your business can count on Tax time and business health reports keep you informed and tax-time readyĪutomatically track your mileage and never miss a mileage deduction again Reports and tools to track money in and out, so you know where you standĮasily log expenses and receipts to ensure your books are always tax-time ready Quick and easy online, recurring, and invoice-free payment optionsĪutomated, to accurately track time and easily log billable hours Wow clients with professional invoices that take seconds to create

0 kommentar(er)

0 kommentar(er)